Quán này tụi mình có dịp ăn bên chi nhánh Lý Tự Trọng rồi, thấy ăn rất ổn nên có giới thiệu vợ chồng đứa bạn. Đợt này đi 2 couples, ăn thử chi nhánh bên đây xem thế nào.

Địa chỉ:

Tầng 5 (L5-01), Vincom Landmark 81, 772 Điện Biên Phủ, P. 22, Q. Bình Thạnh, TP. HCM

Sau đây là 1 vài đánh giá của tụi mình:

Vị trí: trên tầng này có mỗi nhà hàng này thôi, y như “bao lầu”. Dưới tầng 4 là nhà hàng Hoa. Landmark đang hot nên mọi người đổ về đông, nhất là dịp cuối tuần, tụi mình có book trước mà quán không cho luôn.

Không gian: rộng hơn bên chi nhánh kia, nhưng mình cảm giác cách bố trí bàn ghế sát hơn, nên hơi ngộp hơn, lúc khách đông, nhân viên đông chạy đi chạy lại cảm giác chật chội. Trang trí 2 chi nhánh tương đồng, ấn tượng với áo Trung điện trưng bày ngay ngoài cửa (đẹp, sắc sảo, nhìn hàng thật đã…) quán trang trí nhìn sang, nhã, đậm phong cách Hàn.

Menu: ramen ở đây khá đa dạng, từ khô tới nước, từ tonkotsu (hầm xương heo), tới Miso, shoyu (nước tương). Bên cạnh đó có 1 số món phụ như cơm chiên, gyoza…

Phục vụ:

Lúc tới còn 6 tốp nữa mới tới lượt, tụi mình quyết định để tên lại, khi nào đến lượt nhân viên sẽ gọi lên. Chờ hơn 20 phút thì tới lượt, nhanh hơn tụi mình tưởng. Nhìn chung nhân viên lịch sự, nhưng cách nói chuyện cảm giác hơi chảnh.

Món ăn:

Đây là một trong những quán có panchan nhiều và ngon nhất, món yêu thích nhất là món tôm ngâm nước tương (chưa tìm thấy quán khác có món này) tôm mềm, thấm, dẻo, mặn ngọt vừa, ngon. Các loại salad với kim chi cũng rất ok.

Canh đậu tương: vị đậm đà, mùi hơi nặng hơn vài chỗ nhưng ăn quen thì ok, lại càng ngon ah, bắt mắt, ăn với cơm sẽ vừa hơn.

Canh sườn bò: tô canh bự, cục sườn to chà bá, phần thịt được nấu lâu nên rục rồi, thịt mềm, nước canh ngọt thanh, thơm, có cả miến trong này. Món này ngon, nên thử.

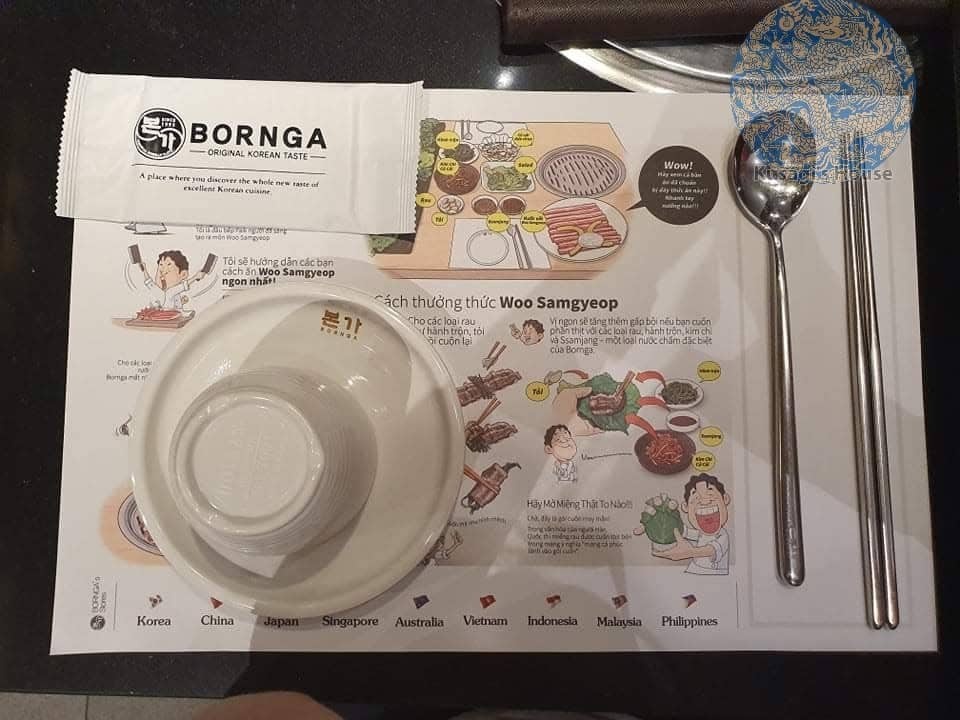

Tụi mình gọi 1 phần Woo samyeopsal, 1 Samyeopsal, 1 phần sườn tươi, bánh sườn băm và rượu gạo vị đào, ham ăn nên thiếu mất vài món rồi.

- Thịt ở đây chắc, ngon, bàn tụi mình có em bé nên nhờ nhân viên nướng dùm, chứ không nướng tại bàn. Thịt có thể chấm với sốt, muối, dầu mè… mỗi thứ đều có vị ngon riêng. Khay rau dài, nhiều, tươi xanh.

- Bánh sườn băm: ăn hơi giống nem nướng của mình vị ngọt ngọt, có bột, mềm, ăn được chứ mình không thích món này lắm vì dễ ngán, chấm sốt giống mayonaise trộn mù tạt, hợp.

- Rượu gạo đào thơm mùi đào lắm, không nồng mùi cồn, vị nhẹ, ngọt ngọt, thanh, dễ uống, ngon hơn loại thường ah.

- Mì lạnh: sợi mì dai (thực ra thấy quán nào bán món này sợi cũng na ná nhau), nước thanh, mát, hơi lạt lạt, có dấm, mù tạt để nêm thêm. Món này ở đây ok, nhưng món này mình thích vị của 1 quán bên quận 7 hơn, đậm ngọt mát hơn.

Bánh sườn băm – 240k

Rượu gạo đào

Bornga Naengmyeon – Mì lạnh Bornga – 180k

Giá cả: Nhà hàng Hàn Quốc này thuộc loại giá cao, menu thịt hơi ít sự lựa chọn, nhưng mọi thứ đều chất lượng, vị làm giống bên Hàn và ngon, một phần đi từ 2-3 người ăn ok, 4 người cảm giác hơi thiếu. Có điều chi nhánh này mình không thích lắm. Nếu ăn lại sẽ ghé chi nhánh khác. Thiệt hại: 2tr564k/ 4 người. Giá trên hình/ menu là giá chưa bao gồm 10% VAT.

Cảm ơn các bạn đã đọc bài viết. Hẹn gặp các bạn ở bài review tiếp theo.

Usagi

https://pharmajetzt.shop/# PharmaJetzt

Узнайте, как создать римские шторы, ваше пространство.

Как сделать римские шторы: инструкция

пошить римские шторы пошить римские шторы .

https://medicijnpunt.com/# MedicijnPunt

заказать металлические значки металлические значки москва

save on pharmacy: PharmaConnectUSA – Pharma Connect USA

apotheke auf rechnung Pharma Jetzt versandapotheke bad steben

Следующая страница Игровые движки

https://t.me/s/CasinoOnline_Martin